I don’t always buy things but when I do, I buy them on Amazon. Everything from dog food to the barefoot shoes I just ordered is bought through Amazon. Is this trend decelerating or accelerating? Everyone is focused on the AI trend. Well, Amazon gets you exposure to that too, more on that later. But how about the elephant in the room?

Conveniency. Amazon has a monopoly on convenience. In between watching Tik-Toks every day, millions of semi-conscious Americans are able to muster up enough energy to order a package that arrives at their doorstep within hours. Amazon’s retail business is an obvious winner, but it’s just the tip of the iceberg. Let’s look a little deeper.

Today I will go over Amazon’s Q2 earnings and get into the Amazon bull thesis of why this company is starting to excite me more and more. I started a position back in May and discuss why in a previous article here:

Why I Bought Amazon Stock

With Prime Day this week I figured it would be a perfect time to discuss the latest addition to the portfolio: Amazon. I started a position a month ago and while it’s already up 10% since, it still seems like a very cheap stock with tremendous upside.

Earnings Recap

AMZN 0.00%↑ posted a great report all around and I believe the company has turned a corner.

They posted $134.4 billion in revenue, an increase of 11% year over year, and $7.7 billion in operating income.

Costs continue to be reigned in while the customer experience continues to improve, it is truly beautiful to watch. They improved their fulfillment and transportation network by transitioning from one national network in the USA to 8 separate regional ones. This has resulted in a 20% reduction in number of touches per package and a 19% decline in miles traveled for delivery. But wait, the benefits don’t stop there:

“Customers care a lot about faster delivery. We have a lot of data that shows when we make faster delivery promises on a detail page, customers purchase more often, not just a little higher, meaningfully higher. It's also true that when customers know they can get their items really quickly, it changes their consideration of using us for future purchases, too.” - CEO Andy Jassy

I will get into why this is so important in the next section, but with decreased costs and happier customers, what more can you ask for?

Ok fine, it gets even better than that. Since shipments are coming from fulfillment centers closer to customers, they travel shorter distances, cost less to transport and get there faster. But it is ALSO better for the environment. In one fell swoop they have ticked all the boxes, even making the ESG folks happy. I can’t wait to see the next argument Lina Kahn comes up with as to why Amazon needs to be broken up.

They have also made tremendous progress with same-day fulfillment centers, which counterintuitively “is our fastest fulfillment mechanism and one of our least expensive, too.”- Jassy

Their speed of delivery has never been faster; across the top 60 largest U.S. metro areas, over 50% of Prime orders arrived same day or next day. They still see many ways to further improve efficiency while constantly trying to improve experiences for customers in the short and long term.

AWS and AI

AWS maintains its significant leadership position and posted 12% growth for the quarter. This in the face of pundits who make the argument “but it is losing market share.” Similar to Tesla, yes, when you are the clear leader and have majority market share, when others enter the market by default your share will decrease. But it’s still… the biggest… by far. Did I mention it’s growing double digits?

While companies like NVDA 0.00%↑ and MSFT 0.00%↑ have received most of the attention in the early innings of AI, Amazon is quietly making significant progress. In my last Amazon article I mentioned Jassy did a CNBC interview saying we were in the hype cycle of AI and what follows will be the actual substance cycle, this tends to be how it goes. I also mentioned how Amazon has been working on its own custom AI chips for several years now. Here are some quotes from Jassy to give you an idea of the bigger picture when it comes to AI, skip for the TLDR:

“Generative AI has captured people's imagination, but most people are talking about the application layer, specifically what OpenAI has done with ChatGPT. It's important to remember that we're in the very early days of the adoption and success of generative AI and that consumer applications is only one layer of the opportunity.”

“We think of large language models in generative AI as having three key layers, all of which are very large in our opinion and all of which AWS is investing heavily in. At the lowest layer is the compute required to train foundational models and new inference or make predictions.”

“That, along with the chip expertise we've built over the last several years, prompted us to start working several years ago on our own custom AI chips for training called Trainium, and inference called Inferentia… We're optimistic that a lot of large language model training and inference will be run on AWS' Trainium and Inferentia chips in the future. We think of the middle layer as being large language models as a service. Stepping back for a second, to develop these large language models, it takes billions of dollars and multiple years to develop.”

“Most companies tell us that they don't want to consume that resource building themselves. Rather, they want access to those large language models, want to customize them with their own data without leaking their proprietary data into the general model, have all the security, privacy, and platform features in AWS work with this new enhanced model, and then have it all wrapped in a managed service…”

“If you think about these first two layers I've talked about, what we're doing is democratizing access to generative AI, lowering the cost of training and running models, enabling access to large language model of choice instead of there only being one option, making it simpler for companies of all sizes and technical acumen to customize their own large language model and build generative AI applications in a secure and enterprise-grade fashion, these are all part of making generative AI accessible to everybody and very much what AWS has been doing for technology infrastructure over the last 17 years.” - Jassy

TLDR: Amazon’s future in AI sounds promising and is receiving little to no credit today. Or in the words CEO Andy Jassy, “I’m very bullish on the growth of AWS over the next several years.”

Notable Mentions

Amazon Pharmacy doubled its active customers in the past year and Whole Foods remains the leader in the organic grocery space. They are doing a bit of everything.

Google and Meta have a duopoly on advertising and it makes up the majority of their revenue. Amazon advertising revenue reached $10.6 billion this quarter and grew 22%. As you see below, every segment with the word “services” is growing double digits. These services were what I said really excited me in my last article about Amazon.

Amazon Bull Case

There is so much more I can go into from the report, but I don’t want this to be too long. As you can see from everything above things are looking great.

Let’s talk about a simple bull case.

While everyone is focused on AI, the real trend that will continue to thrive and make money over the next decade is conveniency. When you look at Amazon’s core retail business, no one can compete with them here. They built out this network over 20 years. Their shipping continues to become more efficient. This is a huge MOAT that as we saw this quarter leads to: cheaper costs, happier customers and customers shopping more often. Add to that the 50 other things Amazon has going for them and you have what I believe is a very exciting story here.

“So far this year, we've delivered more than 1.8 billion units to U.S. Prime members the same or next day, nearly four times what we delivered at those speeds by this point in 2019. Lowering our cost to serve allows us not only to invest in these speed improvements but also add more selection at lower price points. In particular, we're growing our selection in everyday essentials, enabling customers to avoid going out to get these items and both increasing our basket sizes and the frequency with which customers choose to shop with us.” -Jassy

When items ship faster, Prime members shop more often.

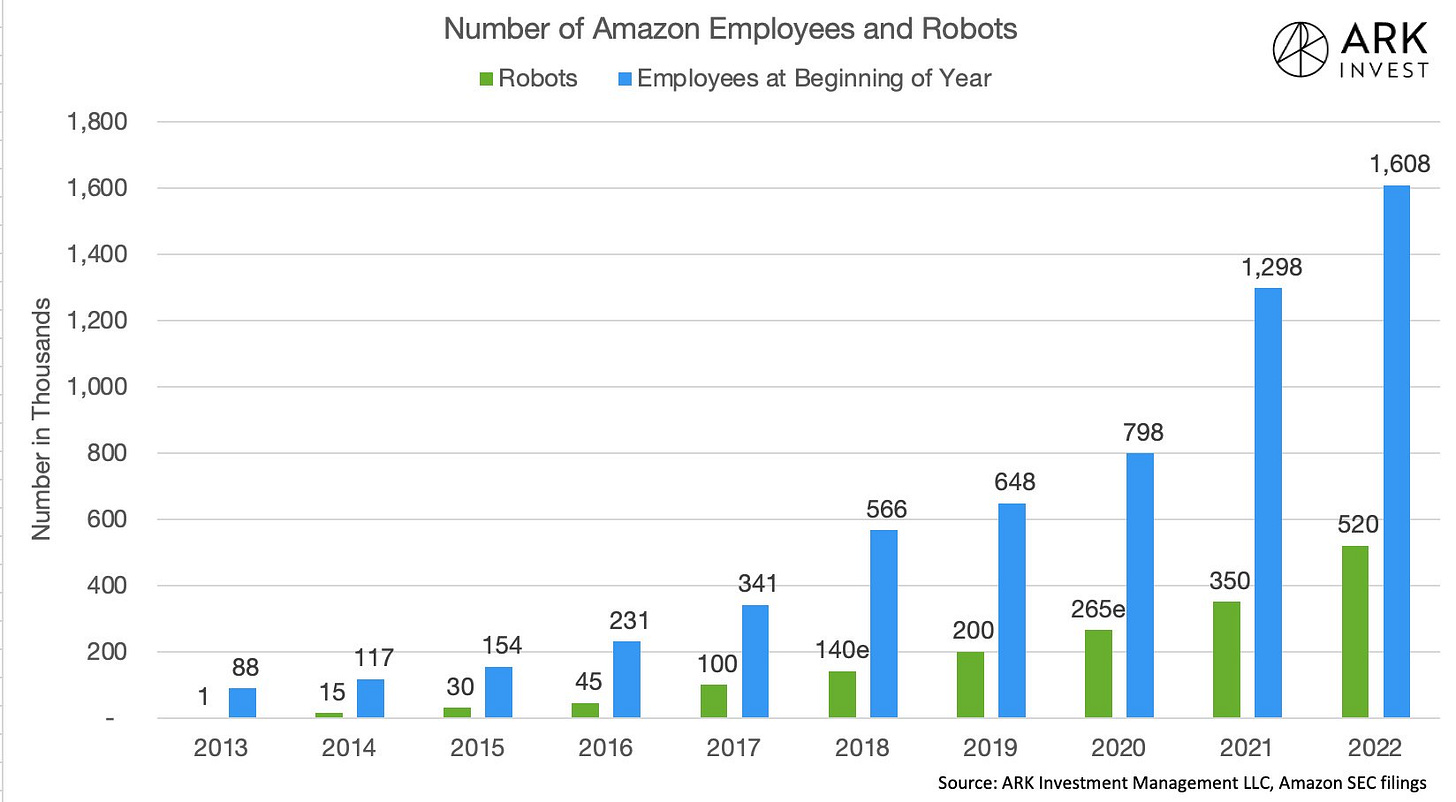

While the core retail business does not have the best margins, they will come. Take the steps outlined in the Q2 report. Pair it with this chart. It’s clear to see where this is going.

There is also a massive runway for growth internationally. It took Amazon 9 years to become profitable in the US, they are in their infancy in many global markets.

Find companies that focus on giving customers the upmost conveniency and ever increasing benefits and I think you will do well. Right now, I can think of no better company at this than Amazon.