Can Chipotle Stock Still Go Higher? CMG Stock Analysis

I just bought a new stock. It’s a company I use often and apparently I’m not alone, as their revenue grew 14% in 2023 and their digital sales grew 37%. The company is the greatest restaurant chain ever created, Chipotle.

It’s a stock that I’ve watched for a long time and it rarely goes on sale, you can never get it for a bargain price, but that tends to be the problem with great companies.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” -Warren Buffett

Widely regarded as the best in class restaurant concept in the fast casual space, Chipotle was the first company to bring the assembly line to the restaurant. The way they move people through the store, or its throughput is incredibly important for both the customer experience and efficiency. While many have since copied this assembly line approach to the restaurant, the company continues to foster a spirit of innovation and improve on this front and more, which we’ll get to later.

In a world full of fast food chains like McDonalds that have pursued the franchise model, Chipotle makes so much money from their restaurants that it did not make sense to utilize a franchise model and instead elected to keep all operations in house. Chipotle has great unit economics. In 2023 the company posted restaurant level margins of 26.2%, among the highest in the industry. The AUV or average unit volume (the amount of revenue an individual Chipotle restaurant brings in) is over $3 million annually.

Digital sales accounted for 37% of their revenue in 2023. As e-commerce wrecked many traditional brick and mortar retailers, it will have similar effects on restaurants and those able to adapt will survive. Not to mention how digital orders by rewards members drive increased sales through both frequency and ticket size.

Starbucks is a great example of a business that benefits greatly from its rewards members, who are nearly 6x more likely to visit a SBUX 0.00%↑ on any given day. Starbucks had 31 million active members as of September, 2023. Chipotle had around 38 million members as of the earnings call in early February, 2024. Not only is there a higher likelihood these customers dine more often as well as spend more, it also gives Chipotle invaluable data on their customers that it can use to plan accordingly. Everything from promotions to optimizing inventory and staffing, it contributes to those high margins.

We recently rolled out suggestive upsell on our app at checkout, based on data we have on our rewards members including prior order history. Going forward, I believe we are on a multiyear path to commercializing our customer data and insights into more targeted marketing campaigns and improving the overall digital experience that will drive increased frequency and spend over time. - CEO Niccol

At a glance, some competitive advantages of CMG 0.00%↑ are summarized by the following:

We will also further strengthen our industry leading value proposition, which consists of delicious culinary, made with real ingredients, that is customizable, convenient, serve quickly, and an accessible price point. -Niccol

53 real ingredients, it’s emphasized everywhere including all over company bags. Endless polls show people are becoming more health conscious and Chipotle is among the healthiest quick service options that exist.

Interestingly, research shows people don’t actually like having a lot of choices, it creates anxiety. Chipotle only offers a few entrees: Burritos, bowls, tacos, salad and quesadillas. This simplicity also leads to better unit economics as everything can be streamlined.

This is a great business and I’ll outline a few of their exciting developments.

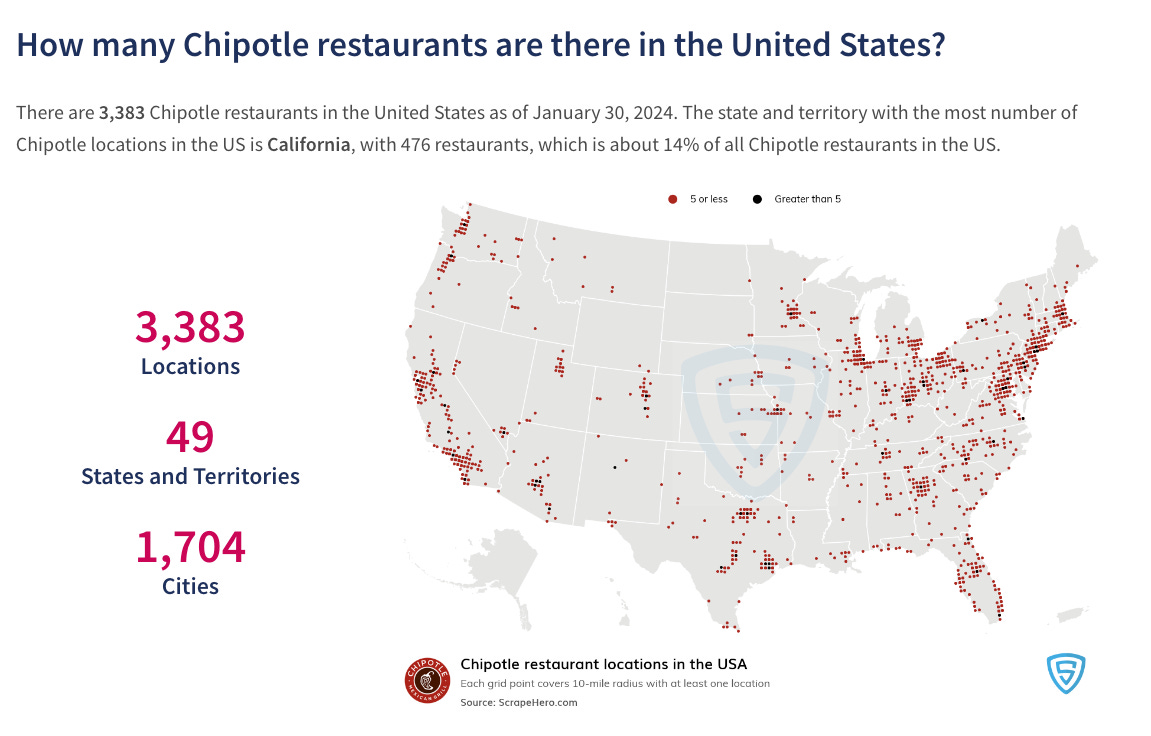

As of January 30, 2024, there were 3,383 Chipotle restaurants in the USA. The company plans to double that number to 7,000 restaurants in North America over the long term and in a recent interview the CEO said 7,000, a double, was a conservative target.

In 2024 they expect to open 285 to 315 new restaurants. Of the 271 new restaurants the company opened in 2023, 238 were “Chipotlanes”. These are innovative drive-thrus, exclusively for mobile orders, where transactions take less than 30 seconds, far less than a traditional drive-thru. For comparison, Taco Bell’s drive-thru speed of service time averages 221 seconds and for Chick Fil-A that service time is 325 seconds. Margins are higher at locations with Chipotlanes and they generate roughly 15% higher sales volumes. I’m yet to come across a Chipotlane but it has clear benefits and is becoming the standard.

So from a shareholder value standpoint, as we open up, as we grow from the 3, 400 towards 7,000, the cash on cash returns we’re getting from, the 80% or 85% of our new restaurants that have Chipotlane is much, much, much higher. - CEO Niccol

The company has made some notable investments and partnerships that I believe further their strengths in efficiency and health appeal:

Hyphen: Partnered with CMG to develop an automated digital make line

Vebu: developing an automated avocado machine to cut cores and scoop avocados called “Autocado”

Greenfield Robotics: “provides regenerative agriculture solutions without chemicals using fleets of autonomous robots to weed fields”

Nitricity: “Uses technology to tackle greenhouse gas emissions by creating natural fertilizer products that are better for fields, farmers and the environment”

One of the companies 5 key areas of focus is “amplifying technology and innovation to drive growth and productivity of our restaurants, support centers, and in our supply chain” which these investments demonstrate.

Hyphen and Vebu’s products are expected to reach the pilot stage in 1 restaurant this year. So while these won’t have meaningful impact short term, I think the greater point is they demonstrate the company’s willingness to think long term, continue to innovate, build on their advantages and strengthen their value proposition when it comes to both efficiency and prioritizing customers’ health.

Speaking of health:

We announced a partnership with Strava, the leading digital community for active people with more than 120 million athletes, to encourage and reward healthy habits with a chance to earn free lifestyle goals. This is giving our fans the right tools to sustain healthy habits in 2024 and beyond.

An investment in Chipotle is an investment in a great business with lots of room for growth, a company willing to pursue technological innovation and continue to find ways to promote a healthy lifestyle. Their current store account is 3,437. Chipotle has a “conservative” goal to more than double that number to 7,000. For perspective, Starbucks had 38,038 locations (as of 2023), McDonald’s 40,275 (as of 2022) globally. Oh, and they want to increase average unit sales per location from $3 million to $4 million. Put this all together and I really like the company’s growth prospects…

Now if you’ll excuse me, I need to go eat some Chipotle.

P.S. If you haven’t already, consider signing up for community access! We have multiple 7 figure stock and real estate investors, weekly zoom calls, stock analyses AND I share all my stock and options trades there. Upgrade your subscription today to get access!