Chipotle Q1 Earnings Breakdown: Beat Estimates, Stock Split Incoming! ($CMG)

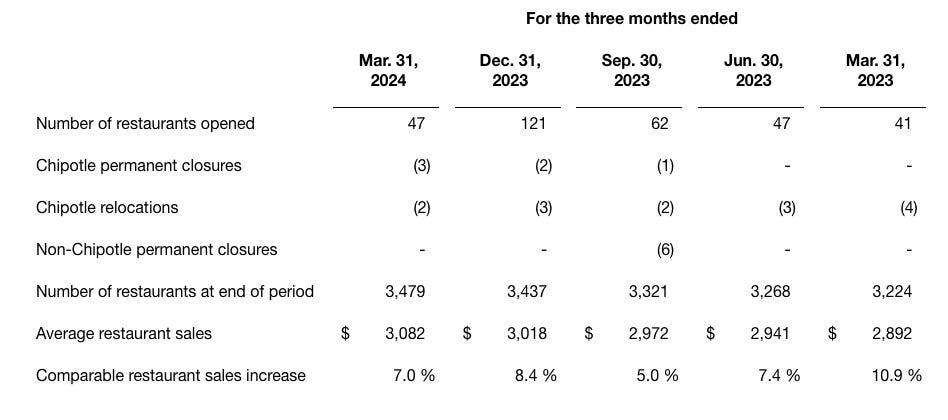

I’ve written a few article on Chipotle, my thesis is a simple one: More restaurants, making more money, over time. As you can see below, they are expanding the restaurant count steadily and aim to double this number in North America to 7,000 long term and average restaurant sales continue to grow nicely. They’re also in the early stages of international expansion.

Restaurant level margins were up to 27.5%, a 2% increase over the prior year. Margins should continue to improve with the company’s various innovation initiatives. Later this year they plan to deploy an automated digital make line and Autocado, an automated avocado core cutter and peeler. In Q1 the company opened 47 new restaurants, 43 of which had a Chipotlane and is on track to open 285-315 new restaurants this year primarily in North America, 80% of which will have Chipotlanes, providing an additional boon to margins.

The company is now up to ~40 million rewards members. Rewards programs and a digital app are a large part of what makes Starbucks so successful so it is great to see Chipotle taking advantage of this technology too. It results in higher frequency as well as higher spend from customers over time.

There are a lot of Chipotle copycats now, but according to the CEO:

As I’ve said in the past, I believe the next Chipotle is Chipotle. - CEO Brian Niccol

I tend to agree, whenever you see a company touted as “the next” anything, RUN! 9 times out of 10 you are better off investing in whatever company follows the words “the next” than the company that precedes them.

On the topic of how communism in America is going,

“In April, minimum wage in California for restaurant companies like ours increased to $20 an hour. As a result, our wages in California went up by nearly 20%, and we subsequently took a 6% to 7% menu price increase in our California restaurants just to cover the cost in dollar terms.”

Short term minimum wage hikes make life more expensive for all of us, long term automation will displace all these jobs. Awesome!

Don’t worry, if you are rich and bribe the government this new era of communism does not apply to you, as bread makers in California will be exempt from this minimum wage bill. This is to benefit Panera Bread almost exclusively, who’s owner is a big political donor! Socialism for the rich, capitalism for everyone else.

Chipotle announced a 50:1 stock split on March 19, one of the largest in history. This will make the stock more accessible for employees and I believe will also get a significant amount of retail investors interested. Even though your ownership of the company remains the same, most people are much more open to paying $60 a share vs. $3,000 a share where CMG 0.00%↑ currently sits. Upon shareholder approval in June, the stock will start trading at the split price on June 26.

The company has a strong balance sheet with $2.2 billion in cash and no debt. The company is in great financial shape and they continue to buy back shares, with $400 million remaining under their current share repurchase plan.

“We have a special brand and unique economic model that allows us to spend more on our ingredients, yet remain one of the most affordable meals in the industry, while also maintaining industry-leading margins. These three characteristics are incredibly difficult to replicate. Premium ingredients, affordable prices, and attractive margins. And this is a huge competitive advantage. And as we continue to protect and strengthen our economic model, the future looks very bright for Chipotle.” - CFO Jack Hartung

On the qualitative level Chipotle is one of the healthiest quick service options that exists. The 3 factors outlined by the CFO, enable Chipotle to offer a very strong value proposition and as a result is seeing sales increase from every income cohort. This is also due to the fact that compared with similar healthier options in the fast casual space, Chipotle is typically 20-30% cheaper. Innovations will continue to enable this, for example there are only around 800 Chipotlanes so far, so 1 in less than 4 Chipotle locations, but they bring much higher margins and 80% of new builds come with Chipotlanes.

They are on their way to 7,000 restaurants in North America, a self declared “conservative” target at the same time AUV / average unit volume per restaurant crossed $3 million and they see a path to $4 million. These are the twin engines of the growth opportunity. Additionally, the company has a high return on capital and free cash flow per share, the number that ultimately matters, continues to march higher.

In my next articles I plan to cover AMZN 0.00%↑ who just reported earnings and possibly SBUX 0.00%↑ who’s stock is down 17% today, so make sure you subscribe below.

Chipotle’s clear value proposition makes it a winner in the fast casual space and restaurants in general as they just continue forward unimpeded by economic factors plaguing their peers.

Until next time!

Check out my last article on Chipotle here: