Today, I’m going to be sharing my October income from YouTube, options trading, and stocks. I know a lot of people are curious about how much money people can make through these avenues, so I thought I’d shed some light on my experience. In total this month I made $3189.50!

YouTube Income

In October I made a whopping $8.45 from YouTube!!

To say I’m playing the long game here is putting it lightly. This is purely from ad revenue, my channel is small one with ~1650 subscribers. I have not taken any sponsorships or sell any of my own products, but these are where I believe the money is long term.

I’ve been toying with the idea of starting a monthly membership service that would offer perks like a Discord community to discuss investing and entrepreneurship. If there is enough interest I’ll do it, but with my small following I figured it may be best to focus on continuing to grow for now and the things that are actually making me decent money like:

Options

Options income: $2,764.

I don’t consider myself a day trader. Roughly 80% of my portfolio is dedicated to long term investing with about 20% devoted to options strategies, though I am definitely focusing more on the latter these days.

I sell premium. I monetize positions I own or would like to own by selling covered calls and puts.

Here’s an example of each.

Calls

Say I have 100 share of Tesla and the stock price is currently around $217. I could sell a call at a strike price of $230 expiring Friday and collect $100 of premium. If the stock is below $230 on Friday, I keep my shares and keep my $100 of premium.

If the stock closes the week above $230 my shares would get called away so I’d get $230 per share plus $100 of premium.

If you pick strike prices you are happy selling your shares at then it’s a win win.

I am trying to have my cake and eat it too as in a perfect world I would like to keep my shares and collect the premium. There are many ways to go about this and barring complete calamity there are strategies I can use to finesse most of the time if the stock has a big week and goes against me.

Puts

With puts the idea is the same but you are picking a price you would like to buy shares at instead of sell.

Ex: I can sell a $200 put on Tesla expiring Friday and collect $100 of premium. All options contracts are for 100 shares so for Tesla it is $200 x 100 shares = $20,000.

Palantir is another stock I’ve used that is cheaper, at $18 x 100 shares = $1,800 per contract.

One of Warren Buffett’s favorite tactics is selling put options as you essentially get paid to wait for a better price.

I have not discussed options a whole lot as it’s more complex but it’s something I’ve been doing for 3 years now. There were a lot of big lessons along the way. If there is an interest I can discuss it more, below you will find every options trade I made in October.

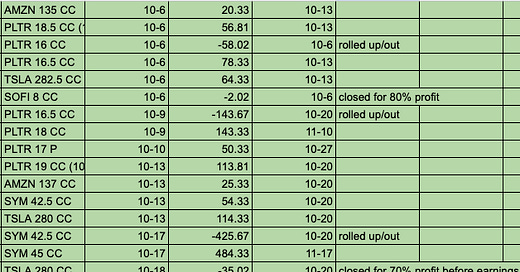

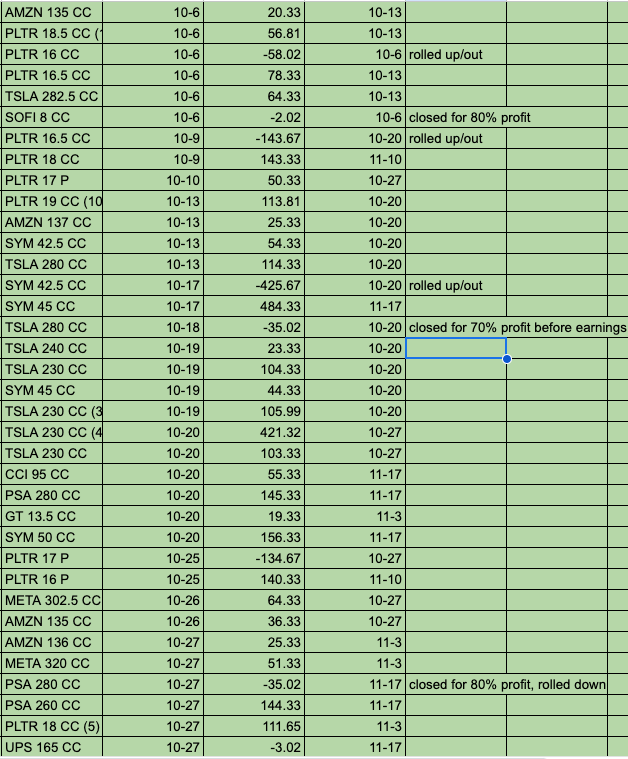

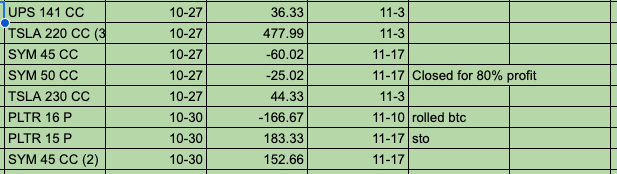

The first column is the stock with the strike price I picked, the # of contracts in parentheses (if it was more than 1 contract) and whether it was a covered call (CC) or Put (P). The second column is the date I sold, the 3rd column is how much premium I collected, the 4th column is the expiration date.

Total premium collected: $2,764

It was a busy month as you can see, I focused mostly on selling covered calls and did a lot of weekly contracts. Sometimes I had to adjust positions that went against me or closed early when it made sense based on what the stock was doing.

Dividends & Interest

Dividends: $88.29

Interest: $328.77

I do own some dividend stocks outright like Realty Income O 0.00%↑ which pays a monthly dividend.

My dividend income fluctuates as most companies pay quarterly. Some of the dividend and interest income is dependent on my options strategy, through positions that have been assigned to me like PSA 0.00%↑ and UPS 0.00%↑. These 2 are great examples of when you sell puts and are assigned, as you can see from my trades above, I turn around and sell covered calls on these positions and collect quarterly dividends.

The interest income is on my cash position, some of which I have put aside for if we crash and some is dedicated to put options that are still open in case we are assigned.

Conclusion

So, this is my income for October. I hope to continue to increase this number, it has been trending up over the past few months as you can see below.

It’s enough money to pay the bills while I figure out next steps for my entrepreneurial journey.

Very nice!! I’m building my dividends up nicely as well, but I need to work on the options because they work very well with some of these dividend etfs