Netflix, Streaming Wars and the Path Forward

A brief look at Netflix's Q2 earnings and their competition

Netflix stock is up 100% since I posted a video on April 20, 2022, outlining why I was buying after what I viewed as a massively unjustified selloff.

NFLX 0.00%↑ has once again sold off brutally after they reported Q2 earnings on Thursday with the stock taking an immediate 10% hit. Tesla also saw a massive dip, despite what I thought was an excellent report, which you can read my commentary on below. Today I want to briefly discuss my thoughts on Netflix’s earnings, the state of the Streaming Wars and consumers’ preferences in general and whether there is a similar opportunity this time.

NFLX Q2 2023 Earnings Key Takeaways

In an attempt to crack down on password sharing, Netflix launched paid sharing in 100+ countries this past May. Despite some initial outrage, how dare Netflix expect people to actually pay for their service, it’s moving along well with sign ups exceeding cancellations. This may come as a surprise but the people who were not paying… had nothing to cancel? There were 5.9 million paid net additions in Q2. Q2 revenue was $8.2 billion with $1.8 billion of operating profit. They expect revenue growth to accelerate in the second half of 2023 as paid sharing and their ad-supported plan continue to grow.

In an ever growing sea of entertainment options, Netflix had the top original streaming series in the USA for 24 of the first 25 weeks of 2023 and the top movie for 21 weeks. It appears they are doing something right and continue to set themself apart from the crowded playing field of streaming options. Netflix has taken a something for everyone approach and owe part of their success to their wide ranging library of content.

A War on Two Fronts

Here is the first problem, which I think is the lesser of two, but nonetheless summarized well in the report.

“Consumers have so many amazing entertainment choices — from movies and TV shows to sports and news to gaming and social media just to name a few. We expect that competition will remain intense, including within streaming.”

“Our biggest traditional entertainment competitors, Disney, Comcast/NBCU, Paramount Global and Warner Brothers Discovery — with their large content libraries and creative expertise — are now focused on profit so they can build sustainable, long term streaming businesses.”

“Our big tech competitors Apple, Amazon and YouTube — with their broad reach and deep pockets — continue to invest heavily to grow their streaming revenues.”

“Netflix’s revenue was $32B in 2022, compared to nearly $40B for YouTube across all its products (trailing 12-month basis as of Q1’23) and Amazon’s $35B subscription revenue in 2022, of which we assume the majority relates to the Prime bundle that includes shipping, video and other services. Combined with Apple’s video initiatives, there’s quite a competitive battle happening.”

-Netflix Q2, 2023, Shareholder Letter

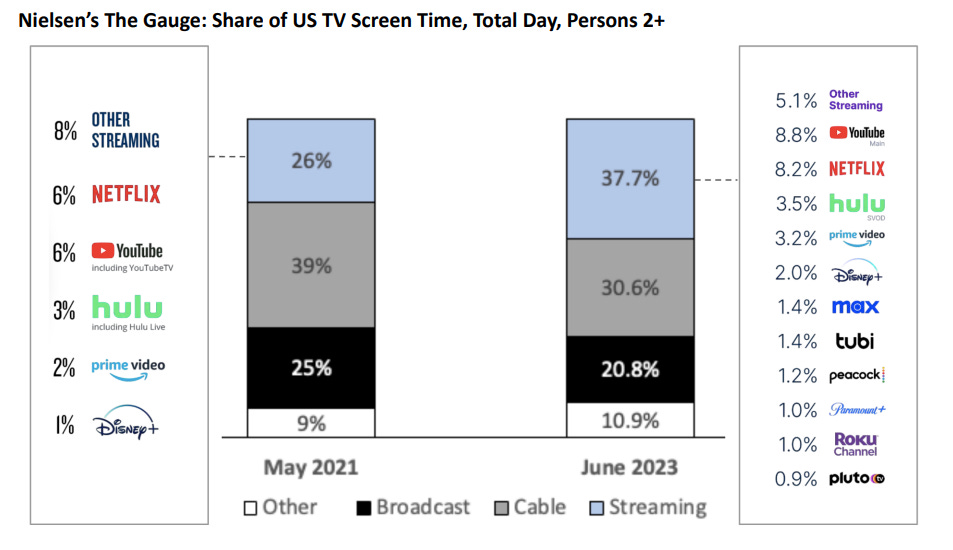

This is a very crowded arena. I think it is a good sign that as you can see, from 2021 to 2023 Netflix has held its own and increased share of US TV screen time from 6% to 8.2%. There is a big enough runway for growth as traditional cable and broadcast continue their rapid decline and there is a big void to fill. Legacy media companies that have not made the jump to streaming are dead on arrival, it’s just too late, and I can’t see those that were late to the party finding much success. I think it is inevitable that they capitulate and are either acquired or agree to license their content to a major streamer. Netflix continues to grow its library of original content that is becoming increasingly popular.

I believe that Disney, despite their best efforts to self sabotage and ostracize 50% of the population, will eventually overcome their woes. It is pretty hard to go wrong when you are a cultural icon that also owns Marvel and Star Wars. The Mouse will always find a way to secure the money bag.

It will be difficult to compete with the deep pockets and bundling capabilities of companies like Amazon with Prime and Apple TV, but not impossible.

I see the next decade as Netflix, Disney, HBO (Sorry, MAX), Prime Video and Apple TV all being able to grow and thrive simultaneously. 300 cable channels existed for 20 years, 5 streamers should be able to share meaningful portions of the market. Maybe there are a couple I missed, let us know in the comments which streaming services you use the most or deserve an honorable mention.

The Second Front

I place Google in this category, with Youtube, which is an entirely different animal. Netflix brought in $32 billion in revenue for 2022 compared with Youtube’s $40 billion. Youtube has better unit economics, they are not producing expensive shows, the creators are. Modern entertainment is ever changing and is not constrained by the traditional rules.

Not to mention the likes of Tik Tok, Reels, Youtube Shorts etc. Even Twitter seems poised to move into the video space, look at Tucker Carlson getting hundreds of millions of views on his videos. I believe it is only a matter of time before many more media personalities, from both sides, go independent and find their way to Twitter.

While I think Tik Tok is a complete cancer to society and has forced others to move to short form content in this attention span race to the bottom, there is no denying these things are taking up more… and more… of peoples’ time every day. Who knows if people will have the attention span to watch a 2 hour movie or even a 30 minute show in 10 years. While I hope for the sake of our collective IQ that is not the future, there is no denying short form content is expanding and at the expense of watching traditional, longer form content. This is a wild card that is hard to predict but it does not seem to bode well for Netflix.

The Rankings

As per the most recent numbers I can find, here are the subscriber rankings. Some important things to note: Prime video is part of the Amazon Prime bundle, Disney+ subscribers have dropped the last 2 quarters and HBO Max changed their name to MAX which is stupid.

Netflix: 238 million

Prime Video: 200+ million

Disney+: 157.8 million

HBO Max: 97.6 million

Paramount+: 60 million

Apple TV+: 25 million (estimated)

Peacock: 21 million

Outlook For Netflix

“We now anticipate at least $5B in FCF for 2023, up from our prior estimate of at least $3.5B. Our updated expectation reflects lower cash content spend in 2023 than we originally anticipated due to timing of production starts and the ongoing WGA and SAG-AFTRA strikes. While this may create some lumpiness in FCF from 2023 to 2024, we plan to deliver substantial positive FCF in 2024”-Netflix Q2, 2023, Shareholder Letter

In the short term, it looks like the latter half of 2023 and 2024 should be better for this company. Over a longer horizon, what is the bull case for Netflix? Video games? Is it a household staple? First mover advantage?

Netflix has a recipe that works and is in large part thanks to their data driven approach. The platform’s personalization and recommendation algorithms are best in class. It is a discovery engine, funneling titles that would not have seen the light of day at a traditional media outlet to the right audience. Content is tailored to user’s interests, creating a highly personalized experience. They can then use everything they know: users’ watch history, preferences and viewing patterns to make informed decisions about what new content they should invest in.

While the above is great, I don’t think it is a strong MOAT as others will figure it out. Therefore, long term their success will rely on their ability to produce franchise IP with a strong value proposition. They’ve succeeded so far as evidenced by some of the major titles listed back in the NFLX Q2 2023 Earnings Key Takeaways section.

When new seasons or sequels to their original shows come out, it reignites interest in older releases of the series. The whole thing goes viral again. Netflix has amassed a huge content library. Their strategy has found international success, something many of their peers struggle to achieve.

I believe it’s only a matter of time until legacy media outlets go bust or are bought out. Many other traditional media companies that are attempting to break into streaming are unprofitable and can’t seem to manage the convergence of media and technology. Most of them are just traditional media companies and you have to be both a media and a technology company to succeed in the modern streaming wars.

Netflix’s growth has slowed quite a bit as you can see when you look at the YoY quarterly growth, but they are still in the lead for paid memberships. They are still growing, albeit modestly, while others like Disney are seeing subscribers decline.

Conclusion

When I posted my original video a year ago, their growth rate was much higher, around 20%. With low single digit growth now, it’s not a name I want to be in as I don’t see a good enough risk to reward ratio. Having said that, Netflix currently has arguably the widest range of content amongst the streaming companies and I have no doubt they will continue to be the industry leader. There is something for everyone and they have found international success. Their personalization and recommendation algorithm, companied with an ever increasing library should retain current customers and maintain their modest growth. I think they will do well relative to their peers and it’s worth following along as I see it as a good industry case study. But a company posting low single digit growth for 4 straight quarters does not scream buy to me; it will take a new engine for growth to be worthwhile and there does not appear to be one right now. Unless there is a big industry shake up where competitors capitulate or Netflix brings forth something revolutionary, it does not seem to be a tremendous opportunity currently.

Let me know what you think in the comments below and I’ll see you next time. If you enjoyed this article consider subscribing or sharing with a friend! I greatly appreciate your time :)