The 2010s were the era of the FAANG stocks (Facebook, Apple, Amazon, Neflix, Google) and the 2020s will be the era of companies that offer a compelling combination of hardware and software. Apple, Tesla and more recently Meta, formerly Facebook, come to mind. In the case of Meta, we may look back in a few years and see this decision actually saved the company. I plan to cover Meta in a future deep dive so stick around if you’re interested. Of course, I believe Symbotic also has a compelling offer that includes both state of the art hardware and subscription based software that will bring them monthly recurring revenue for years to come.

Background

Symbotic went public in 2022 but it is far from novelty. A founder led company with an $11 billion revenue backlog with major clients including Walmart, SYM presents an intriguing investment opportunity. It also has striking similarities to Tesla and Palantir. Here is a deep dive into the company which I will follow up in a future article with a breakdown of their Q4 ‘22 earnings report.

Symbotic is a warehouse automation company that reimagines the warehouse and turns the supply chain into a competitive advantage. It is a founder led company started by Rick Cohen who saw a need in his own business, C&S Wholesale Grocers. This is how Symbotic was born. Cohen is the owner of C&S Grocers, the 8th largest privately held company in the USA and the largest grocery wholesaler. Symbotic came about through Rick’s efforts and inventions to optimize C&S’ warehouses. Cohen is a visionary leader with skin in the game, having quietly started the company 15 years ago and funding it with his own cash, prior to Symbotic going public via SPAC in 2022.

Opportunity

The global warehousing and storage services market was valued at $648 billion in 2021 and is projected to reach $1.2 trillion by 2030. I believe warehouse automation is the future and Symbotic is poised to capitalize on this trend. Their system employs both a fleet of fully autonomous robots as well as artificial intelligence powered software in order to improve efficiency, accuracy and agility while also reducing costs.

“The need for accuracy and speed in the supply chain has never been more visible, and we’re confident that now is the time to move even faster by scaling Symbotic’s technology to our entire regional distribution center network.”

“Using high-speed robotics and intelligent software to organize and optimize inventory, the Symbotic System helps us get products to our customers quickly and seamlessly by revolutionizing how we receive and distribute products to stores.”

-David Guggina, SVP of Innovation and Automation, Walmart U.S.

There are quite a few tail winds for this industry. Optimizing warehouses and distribution centers has obvious benefits for companies’ efficiency and bottom lines. As the world faces the simultaneous impacts of labor pressures as well as the onset of AI and automation, there is an extensive runway ahead to transform $1 trillion of market spend. While other solutions exist, they either face single points of failure or do not address the whole, whereas Symbotic offers an all in one AI powered automation solution. Symbotic’s robots can travel up to 25 MPH and in contrast to other automation systems, their robots are untethered, rather than bolted down or limited to fixed routes.

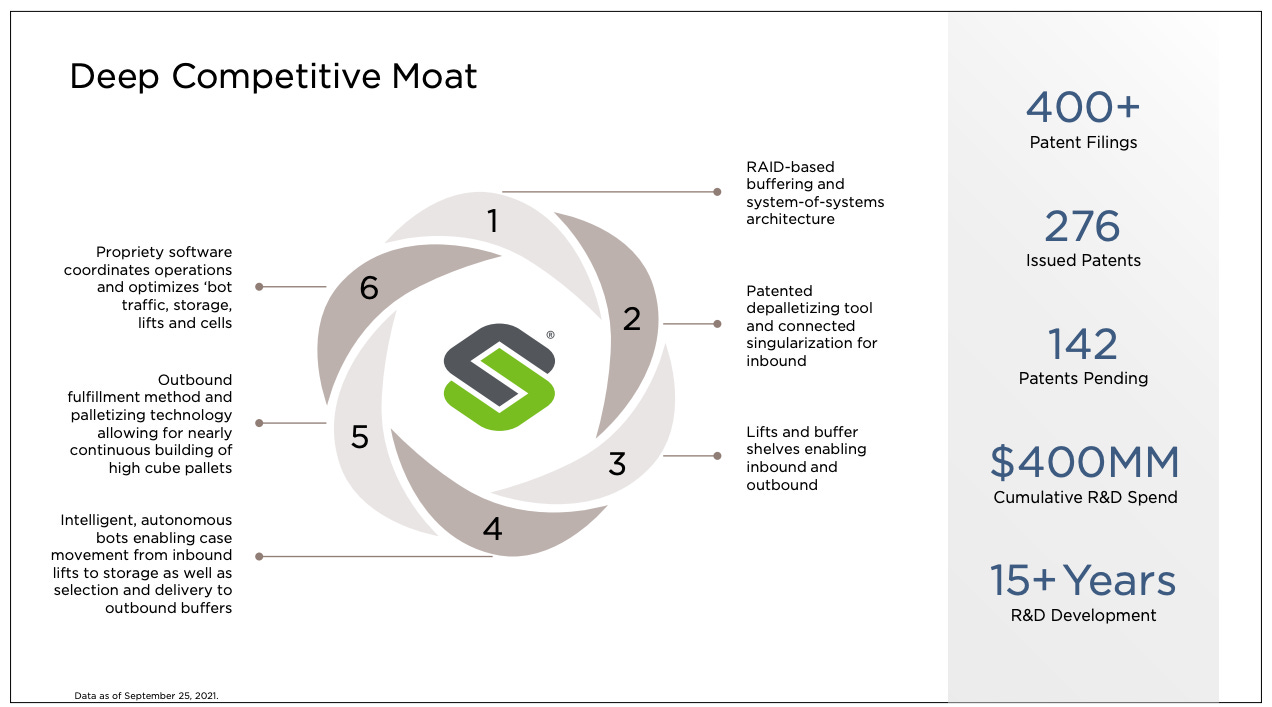

SYM has a deep competitive MOAT. As of their July 2022 investor presentation, here are a few: 276 issued patents, including their patented de-palletizing tool, 15+ years of R&D development and much more.

SYM is in a hyper growth phase, projecting revenue CAGR of 86% from 2020-2025. They have a rapidly growing backlog of $11 billion, which was just $5 billion a few months ago. They are also forecasting 25% EBITDA margin as the business scales and due to their CapEx-light business model, significant free cash flow generation by end of 2025.

The following is a sample contract summary. There are 3 major components.

The Symbotic system

Annual software subscription and support

System operation services and parts

The Symbotic system is purchased by a customer. The system implementation and related revenue is spread over 6-12 months from the contract date.

Then, there is an annual software subscription and support segment required to use the system, as well as system operation services and parts.

Annual software subscription and operation services start when the system is deemed operational, 6-12 months after the initial contract date.

Walmart is their largest customer, hoping to stay competitive with Amazon, who implemented their own warehouse automation system. But Amazon does not want to share.

Originally, Walmart wanted Symbotic to retrofit 25 of their regional distribution centers. Well, they later decided to expand that commitment to all 42 of their regional distribution centers. This is to be carried out over the next 8 years and makes up a solid chunk of their $11 billion backlog.

Customers

The technology from Symbotic does things differently… In short, this is a game changer. - Joe Metzger, Executive Vice President of Supply Chain Operations, Walmart, U.S.

There is concentration risk with Symbotic as they only have a few customers so far and Walmart is the largest by a huge margin. Their customers include Walmart, C&S Wholesale Grocers, Albertsons, Target, Giant Tiger and UNFI.

MOAT

The presence of a defensible MOAT is key for any business to thrive. MOATs can manifest themselves in many different ways, both quantitative and qualitative.

One form a MOAT can take is possessing a strong brand. While Symbotic is relatively new and under the radar, I would say it still has a strong brand, primarily stemming from 2 facets.

Rick Cohen

Walmart

Rick Cohen is a highly successful businessman with a proven track record. He did turn C&S Grocers into the 8th largest privately held company and largest wholesale grocer after all. I would imagine he is well connected.

Walmart taking a leap of faith with Symbotic and going from having SYM installed in 25 of its regional distribution centers to all 42 is either a sign of sheer desperation or a testament to Symbotic’s brand. Clearly, Walmart was impressed and I trust their management’s due diligence.

High switching costs are clearly present. It would cost a company a lot of time and money to exit Symbotic’s ecosystem as it costs anywhere from $50-100 million to install their system. Not to mention their system is unique, so you would need to remove the entire system and start from scratch with a new company, if the alternative is even able to retrofit your existing factory as is. It seems safe to assume that Symbotic’s product is a sticky one.

Supply chains and warehouses are part of a stable industry. While companies like Amazon have had to cut back their footprint over the past year primarily due to overextending in response to pandemic trends, it is clear warehouses are here to stay. Whether the number of warehouses continue to expand, they will definitely need to optimize, which in either case benefits Symbotic.

There is a potential for high ROIC or return on invested capital because of their business model. Over time a growing chunk of Symbotic’s revenue will come from software subscriptions. This will bring with it high profit margins. High gross margins are perhaps the single most important factor when determining long term performance. Symbotic will create stickiness, due to the high switching costs mentioned above, and with that will come loads of recurring revenue from software and system maintenance.

It is clear Symbotic brings a high level of value added for its customers. A $50 million investment in their system yields a high ROI and many tangible benefits, as seen in this slide from their management presentation. The system can save a customer $10 million a year or $250 million over 25 years. With a cost of $50 million for the system and $10 million in savings year one, I would say a 20% immediate return is not a bad return on investment.

Here are some additional aspects of Symbotic’s MOAT including 400+ patent filings.

SYM: Parallels to Tesla and Palantir

You’re probably wondering what this company has to do with Tesla and Palantir, as the title suggests. I own both Tesla and Palantir and couldn’t help but draw parallels between the 3 companies as I was researching Symbotic. Here are some similarities:

All 3 companies are founder led and all 3 founders seem to have a knack for product and engineering. I think this is great, especially when trying to find potential 100 bagger investments, as founder led companies with people who really understand the product at the helm will almost always beat out MBAs. This is because they focus on what is truly important: how to make the best product and how to optimize it, which I find to be a superior approach to the short term appeasement of Wall Street.

When asked about competition during the Q3 call, management stated that they think they are the only ones REALLY using A.I. and autonomous vehicles in this type of unique solution. Additionally, since their entire system is software-driven, it is difficult to replicate.

Symbotic has an A.I. engine that can efficiently analyze massive amounts of data and create digital twins. Warehouse operations carry tremendous amounts of data. The Symbotic A.I. engine analyzes 6 terabytes of data daily through each system. This enables them to self learn, continuously improve and extend their lead in the market.

Tesla, Palantir and Symbotic are all involved in artificial intelligence as well as organizing and analyzing massive amounts of data.

Tesla has a fleet of autonomous cars, Symbotic has a fleet of autonomous bots. Tesla employs a high level of robotics in their factories, minimizing the need for human labor, as does Symbotic.

Rick Cohen’s leadership and vision is centered around a culture of continuing innovation. All 3 companies seem to share visionary leadership centered around a culture of innovation and continuous improvement.

Financials

For Q3 of 2022, Symbotic posted revenue of $175.6 million, a quarterly loss of $32.9 million and adjusted EBITDA loss of $21.8 million. In the same quarter in 2021, they had revenue of $131.5 million, quarterly net loss of $37.8 million and adjusted EBITDA loss of $28.1 million. Revenue in the 3rd quarter grew 82% over the prior year and they appear to be trending in the right direction. They also accelerated to 13 system deployments in progress during the quarter, up from only 4 in Q3 of 2021.

Their 2022 year end expectations as of the end of Q3 ‘22 are as follows. They expect 2022 revenue of $490 million to $510 million, nearly a double of their 2021 revenue. They expect an adjusted EBITDA loss of $94-90 million. They ended Q3 ‘22 with $412 million in cash and cash equivalents, zero debt and contracted orders valued at $11.3 billion. There is clear visibility of their future growth.

Conclusion

While the company is losing money for now, they are in a hyper growth phase. The $11 billion backlog should enable them to keep the lights on for the next 5-10 years. I can only imagine that backlog will expand as word reaches other companies on how exceptional this system is. Symbotic solves many of the headwinds facing the supply chain industry. Symbotic’s similarities to Tesla and Palantir, 2 of my other investments, has piqued my interest. I plan to give a breakdown of their Q4 results in the future. If you enjoyed this article, consider subscribing and share your thoughts below. Until next time!