It’s no surprise that Tesla posted a lackluster earnings report in a world that seems on the brink of World War III, companied with sky high inflation and interest rates.

People are not exactly clamoring at the idea of buying an expensive electric vehicle right now that, if financed, will entail a monthly payment number that seems fit only for home mortgages.

We are in a tough and uncertain spot right now in many ways. Considering all this, Tesla posted a good report in that they are still growing and cash flow positive.

Perhaps due to the high standard we’ve come to expect after Tesla seemed to only win and always figure it out the past few years means that a good quarter, generally speaking, and a good quarter for Tesla are 2 very different things.

This was the first earnings call I can remember that did not leave me inspired and optimistic. Elon Musk sounded exhausted and perhaps even depressed. While long term I still think they will do great, the next 12 months could be rough, buckle up. The market seems to agree with TSLA 0.00%↑ down 15% in the past week.

Let’s look at the key takeaways.

The Positives

Tesla continues to drive down costs both through economy of scale and a relentless drive to optimize. In reading Walter Isaacson’s biography of Elon Musk, this comes up again and again. There is a sheer determination to continuously improve efficiency. Since Tesla’s inception Elon has personally patrolled the factory floor asking why things that seem silly or slow down the production process are necessary and wherever possible, “deleting” said bottlenecks.

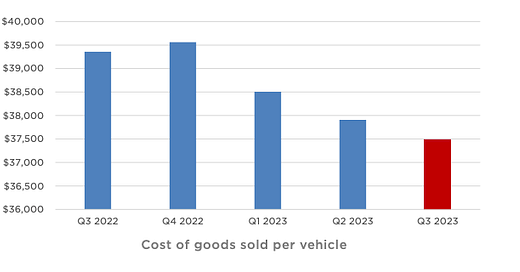

This trend will continue and is at least partially offsetting decreases in ASP (average sale price). As you can see in the above chart, the cost per vehicle is down $2,000 over the past year.

That’s over a 5% increase in efficiency in 1 year, while also ramping multiple new factories. Show me another company manufacturing complex expensive products that cuts costs by 5% in a single year.

We continue to believe that an industry leader needs to be a cost leader. -Tesla Q3

Another bright spot is energy storage deployments which increased 90% year over year. Tesla’s Megafactory in Lathrop produced 4 GWh in Q3 and at full capacity will be able to produce 40 GWh a year.

The Negat- Err Other Stuff

Our main objectives remained unchanged in Q3-2023: reducing cost per vehicle, free cash flow generation while maximizing delivery volumes and continued investment in AI and other growth projects. - Tesla Q3

As I comb through the report again it doesn’t seem terrible and I refer back to my intro at the top. I think any company that is able to show growth right now is very impressive when you think about all the headwinds, especially for a company like Tesla, yet they are still on track to grow their vehicle deliveries ~50% year over year.

As Elon said on the call:

I mean, [at] the risk of stating the obvious, it's not possible to have a compound growth rate of 50% forever or you will exceed the mass of the known universe.

But I think we will grow very rapidly, much faster than any other car company on Earth, by far.

Profitability has gone down significantly, but this was already guided for:

Our main objectives remained unchanged in Q3-2023: reducing cost per vehicle, free cash flow generation while maximizing delivery volumes and continued investment in AI and other growth projects.

This seems to be the right approach. Tesla has a strong balance sheet. As long as they continue to generate some free cash flow and simultaneously invest in the future, their position grows stronger.

The red column is the current quarter and as you can see the company generated $3.3 billion in operating cash flow and spent an all time high on capital expenditures, $2.4 billion. So they were able to reinvest into the business 20% more than the prior 2 quarters and still generate $848 million in free cash flow. Their cash position is now up to $26 billion and the balance sheet remains a fortress.

During a high interest rate environment, we believe focusing on investments in R&D and capital expenditures for future growth, while maintaining positive free cash flow, is the right approach.

There is no question that Tesla is by far the most well positioned company in the auto market. Plus, it is STILL the only company producing electric vehicles at a profit.

Conclusion

While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied by an acceleration of AI, software and fleet-based profits.

The long awaited Cybertruck delivery event is slated for November and this is a product sure to generate a lot of buzz.

Tesla will prudently continue to optimize and invest for the long term.

You know we’re heading into uncertain times when a company like Tesla that seems to always move at warp speed has deferred to a cautious approach, at least for the time being.