Why Chipotle Is Crushing It

Chipotle is a winning long term stock. TGI Fridays just filed for bankruptcy. Recently Red Lobster and Buca Di Beppo also filed for bankruptcy. Last month Denny’s announced its closing 150 of its lowest performing restaurants and Wendys aims to close 140 more stores by year end. Traditional sit-down chain restaurants have struggled in recent years as trends shift, consumers choose to get food delivered and visit upscale fast-food chains like Chipotle instead.

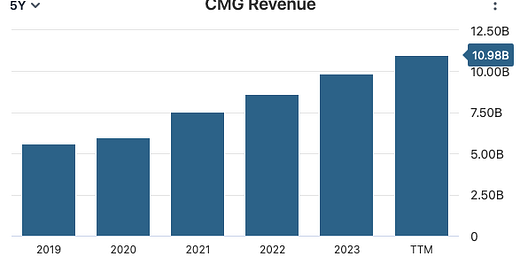

You continue to see many cultural icons of the past struggle and their revenue decline. Simultaneously Chipotle just continues to grow.

The new wave of restaurants I would consider upscale or quick service that are taking over include names like Chipotle, Starbucks, Dutch Bros and Sweet Green.

I’ve written about Chipotle and Starbucks at length in previous articles. Here’s a link to previous ones:

I was recently on a Carnival cruise, which I will definitely discuss in a future article because the cruise lines are poised to continue delivering exceptional returns. Carnival CCL 0.00%↑ is up 75% in the past year and Royal Carribean RCL 0.00%↑ is up 120%, cruise lines are far outperforming big tech and most AI companies.

While on the cruise we visited Carribean islands like the Bahamas and Grand Turk. Do you know what all these islands had in common? A Starbucks loaded with tourists. Even on vacation people need to get their fix. In one case the Starbucks did not even have coffee to sell as their espresso machine was out. People were still buying their fruity drinks and frappucinos, which are essentially just milkshakes. I wouldn’t be surprised if Starbucks is in part responsible for ice cream shops like Carvel’s decline either.

So, there is clearly a new class of quick service or upscale fast food, whatever you want to call it, that is taking market share.

I’ve discussed Chipotle’s other strengths at length in previous articles, but I think a big one worth repeating is their focus on freshness and health, everything there is made with 53 real ingredients.

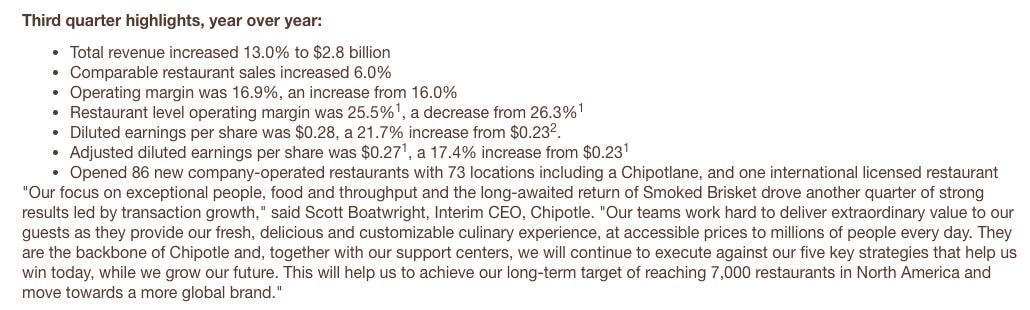

So with that let’s turn to their q3 earnings. Here are the highlights which I’ve summarized below:

Q3 Highlights

Revenue up 13% to $2.8 billion for the quarter

Comparable restaurant sales increased 6%

Opened 86 new locations with 73 including a Chipotlane

Digital sales represented 34% of food and beverage revenue

Stock buybacks of $488.1 million in the quarter

Long term target remains 7,000 restaurants in North America and a global brand

Guidance

For 2024, comparable restaurant sales growth mid to high single digits

285 to 315 new locations with 80% having a Chipotlane

For 2025, 315 to 345 new company operated restaurants, 80% having a Chipotlane

Restaurant level operating margin decreased slightly from 26.3% to 25.5%. I expected this and said as much in my last article after the previous CEO hinted it was topping out. You can only increase prices so much in the short term.

On the call it was stated that there are over 3,600 Chipotle locations currently. With their long term target the restaurant count would double and comparable restaurant sales continue to increase. They aim to increase AUV (average unit volume) or the average revenue of each restaurant, to $4 million. With 7,000 locations that would equal $28 billion in revenue, nearly triple today’s total revenue.

This is a business that is all about increasing efficiency and they have several back end automation projects underway that. They’re even using a new AI hiring platform that reduces the time it takes to hire an in-restaurant employee by 75%.

The interim CEO, filling in for Brian Niccol since his departure for Starbucks, stated this gives them a competitive advantage over other restaurants in the high volume hiring market because they can hire talent faster. Chipotle ranked 1st in the American Opportunity Index of best places for high school graduates to start a career. The company has a goal of promoting over 90% from within.

Their international roll out is going well and the CEO stated it “…is further strengthening our confidence that Chipotle's responsibly sourced, classically cooked, real ingredients resonates across geographies.”

The company is seeing strength across all income cohorts. A chicken burrito is still less than $10 on average, a 15 to 30% discount compared to Chipotle’s peer group.

“The future is very bright at Chipotle.” - Scott Boatwright, interim CEO

I agree with the CEO and think this is a solid one to tuck away in my long term portfolio. Chipotle is a special brand. Their unique model enables them to spend more on real ingredients yet still offer great value to consumers, while simultaneously maintaining industry leading profit margins.

Every time I write about Chipotle it makes me crave it so I know where I’m getting lunch today.

Until next time!