Amazon: Why It's Time to Buy the Stock

Amazon brought in $554 billion in revenue over the past 12 months. Apple, the world’s largest company which is set to report later today, brought in $384 billion over the past 12 months (as of the quarter ending June 30, 2023).

Yet while Amazon continues double digit growth in important segments like advertising, AWS and subscription services, AAPL 0.00%↑ has seen its revenue decline for 3 straight quarters and today we will find out if it will be the 4th.

I like to compare these 2 companies in no way to discredit Apple, it’s a great company of course, but it has a market cap that is double that of AMZN 0.00%↑.

Due to this and the following factors I’ll discuss from their Q3 earnings, I believe Amazon is the better buy and it’s quickly become my 2nd favorite company, behind TSLA 0.00%↑ of course. But with the outlook for the next 12 months and Tesla’s gloomy earnings call, in the short term I would pick Amazon over Tesla if I were to increase my position in either.

You can read my latest Tesla article here:

Amazon Q3

“We had a strong third quarter as our cost to serve and speed of delivery in our Stores business took another step forward…The benefits of moving from a single national fulfillment network in the U.S. to eight distinct regions are exceeding our optimistic expectations, and perhaps most importantly, putting us on pace to deliver the fastest delivery speeds for Prime customers in our 29-year history.” -Andy Jassy, Amazon CEO

As the company has stated in the past, the faster they are able to deliver goods, the more often consumers shop. Revenue is growing and profits are starting to follow thanks to optimizations and the growth of higher margin segments like advertising.

Put it all together and you have a flywheel effect, which is essentially the accumulation of many small wins that compound to create a virtuous cycle with sustained periods of high growth.

Take Amazon’s fulfillment network outlined above, it was built out over 2 decades. It is now hyper optimized for speed, enabling it to move into new verticals like healthcare with the delivery of prescription medications. Add in innovative initiatives like robotics and the switch to electric delivery vans with Amazon’s investment in Rivian and the entire process has become a self reinforcing virtuous cycle that the company can continue to build on with ease.

Healthcare

An investment in Amazon today gets you a free call option on what as of 2021 was an $808 billion industry in the United States. The global healthcare industry is worth $12 trillion. The healthcare industry is projected to grow faster than any other sector in the US economy.

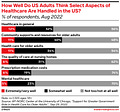

There is a huge opportunity here and as you can see from the deep dissatisfaction below, it is ripe for innovation:

Prescription medication costs had the worst score with 74% of respondents dissatisfied; it’s no surprise this is what Amazon decided to start with. They know where all the best opportunities are…

On the call the company announced some updates to their healthcare forays including:

“Announced new offerings to help customers get and stay healthy, including an expanded Amazon Clinic virtual health care marketplace now available across the U.S. to provide care for more than 35 conditions, and 60-minute delivery of medications through Amazon Pharmacy using Prime Air drones in College Station, Texas.”

“Additionally, Amazon Pharmacy partnered with Blue Shield of California on a first-of-its-kind model to provide more affordable pharmacy care to its members, where Amazon Pharmacy will offer fast, free home delivery of prescription medications to more than 4.8 million Blue Shield of California members, starting in 2025.”

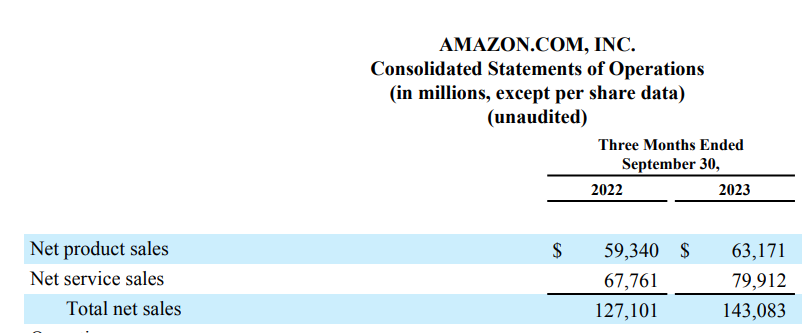

Impressive Growth

They posted impressive sales growth and as I’ve discussed in past articles, the services segment is what I’m more focused on as it comprises higher margin segments of the business like 3rd party seller services, advertising, AWS and subscriptions. So to see it grow at 18% year over year and be running away from product sales is a great sign. Below you can see the breakdown of these various segments.

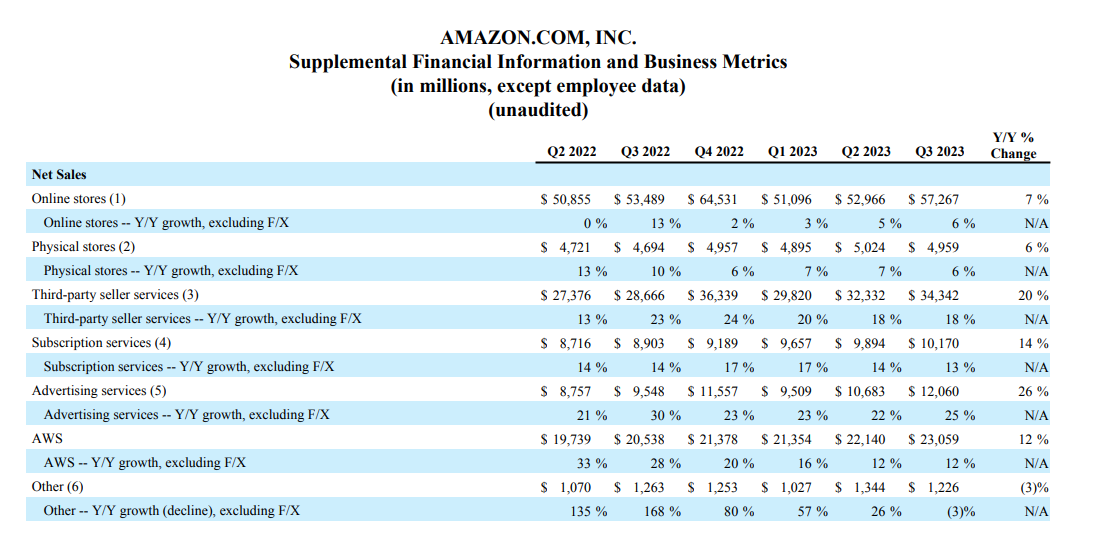

Once again, every services segment saw double digit growth, led by advertising with a whopping 25% growth year over year. As you can see advertising has grown 21% plus for the last 6 quarters.

As I’ve stated in the past, GOOGL 0.00%↑ and META 0.00%↑ have long held a duopoly on digital advertising. It seems Amazon’s advertisements convert at a much higher rate thanks to all the data they have on peoples’ shopping habits so this segment seems to be in its infancy.

Here are some interesting quotes from the call on the advertising industry trends, I believe this segment will continue to be a vital engine of growth and profit for Amazon:

If you look around the industry, most advertising-heavy companies have struggled growth-wise as the economy has been difficult…

And I think in these types of economies, we have fared pretty well… Even in a harder economy, there's going to be a lot of e-commerce purchasing…

…take "Thursday Night Football,"… we're doing much better on the advertising side than we did in our first year, and that's a property that's really valuable. It's the one game that week, and advertisers want to be in front of customers because there's 13 million customers a week watching.

…And then I think the other piece is that most of our resource in the advertising side is spent on machine learning expert practitioners who are honing algorithms to make sure that the sponsored results people get when they search on something are relevant.

And because of that, those ads perform better for advertisers. So, when they have to think about budget decisions, they're going to choose the ones that have large volume and perform better. I think both of those are real advantages in our advertising area right now. In terms of additional things we're excited about.

I think that we have barely scraped the surface with respect to figuring out how to intelligently integrate advertising into video, into audio and into grocery. So, I think we're early days in that. - CEO Andy Jassy

Speaking of infancy, look at AWS. Jassy said he thinks 90% of the world’s IT is still physically on premise, so despite AWS’ already near $100 billion annual revenue run rate, they have barely penetrated this market:

“And then we have a $92 billion revenue run rate business where 90% of the global IT spend still resides on premises.” - Jassy

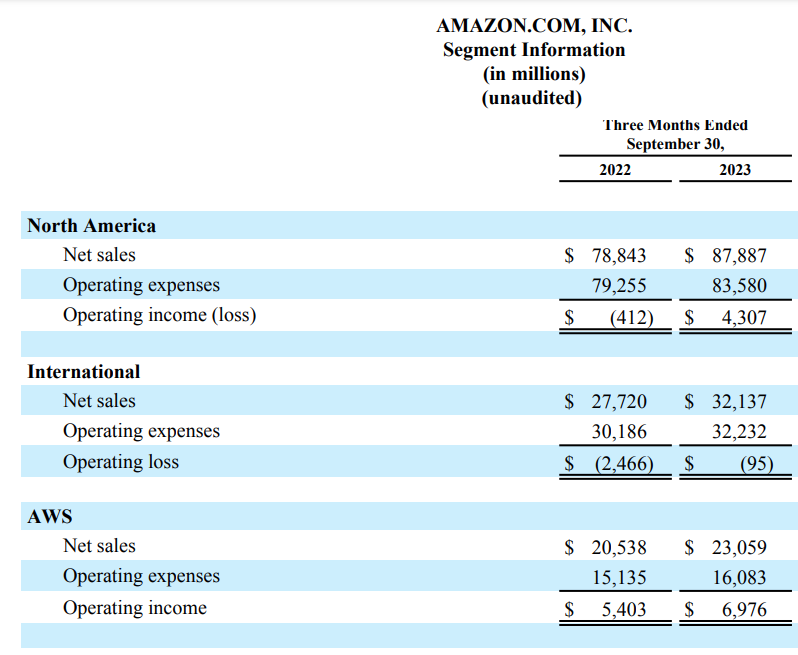

Amazon’s international segment is about to flip positive and they’ve mentioned that they are already profitable in many specific countries. All 3 segments grew double digits: 11% for North America, 16% internationally and 12% for AWS.

“In our established countries, U.K., Germany, Japan, France, those countries are profitable and have been profitable.” - Brian Olavsky, CFO

North America makes up 61% of revenue, international 23% and AWS 16%. Lots of room for growth internationally and for AWS.

Conclusion

Let this sink in:

Facebook’s parent company META 0.00%↑ has 4 billion monthly active users. Amazon Prime has only 200 million members. One wastes your life, the other makes it easier.

The runway for growth is absolutely massive. The company already brings in the most revenue of any company on the planet, they can basically flip a switch and start massively increasing profits. Throw in the high margin service segments that are growing fast; double digit growth in an economy that is wrecking most other companies.

It’s becoming clear to me, the companies I want to invest in are the ones that do especially well in the tough times such that we currently find ourselves in. Anyone can grow when interest rates are effectively 0. But to grow vital segments double digits consistently through this downturn? That tells me everything I need to know.

They will continue to follow this playbook:

Faster deliveries → More purchases → More revenue → Throw in high margin services segments → Optimize profits → Enter New Verticals → Repeat

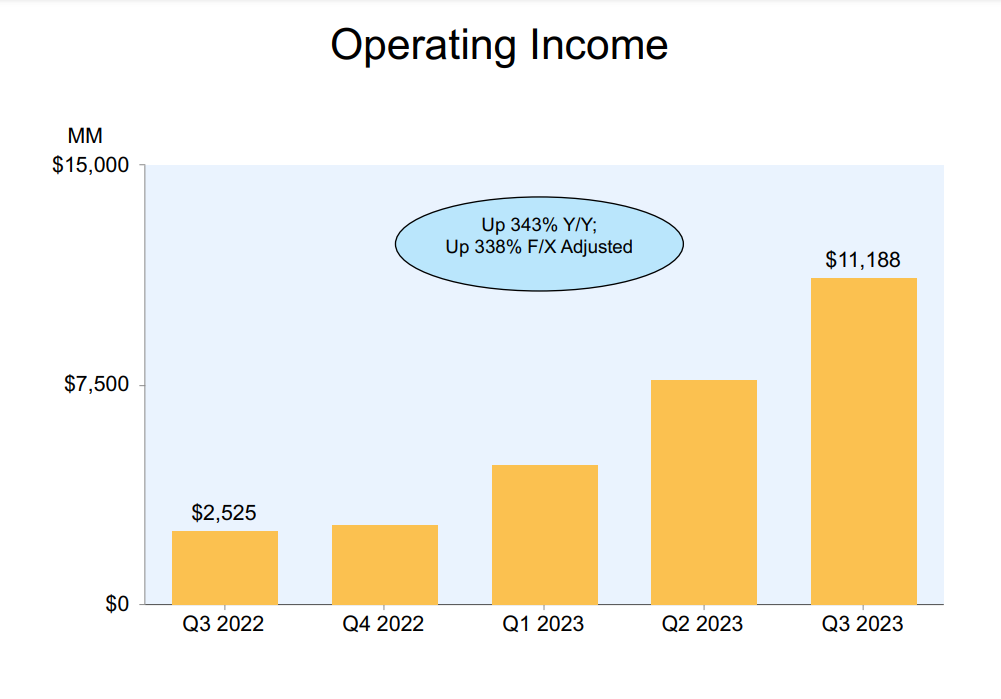

This is the result, operating income skyrocketing 343% year over year

There is so much room for growth when we look internationally and at AWS as mentioned above. The outlook for the company is looking better each quarter and judging by the stock’s 15% run up over the past week, it appears Wall Street is starting to agree.

Here are the full quotes from the advertising segment above if you’re interested. There is just so much useful information:

If you look around the industry, most advertising-heavy companies have struggled growth-wise as the economy has been difficult. And while we see companies being more cautious on the ad side and the top-of-funnel products, things like display and a little bit of video, we're still seeing a lot of strength in the lower-funnel ad products like sponsored products.

And I think in these types of economies, we have fared pretty well in part because we have a number of owned and operated properties that have very large volumes that advertisers and brands want to get in front of. Even in a harder economy, there's going to be a lot of e-commerce purchasing. So, people want to be in front of our customers in our marketplace. Or take "Thursday Night Football," which is we're in our second season of "Thursday Night Football," and off to a great start, the ratings are 25% higher than they were a year ago through six weeks.

But also, we're doing much better on the advertising side than we did in our first year, and that's a property that's really valuable. It's the one game that week, and advertisers want to be in front of customers because there's 13 million customers a week watching. So, I think part of it is because we have owned and operated properties that have a lot of volume. And then I think the other piece is that most of our resource in the advertising side is spent on machine learning expert practitioners who are honing algorithms to make sure that the sponsored results people get when they search on something are relevant.

And because of that, those ads perform better for advertisers. So, when they have to think about budget decisions, they're going to choose the ones that have large volume and perform better. I think both of those are real advantages in our advertising area right now. In terms of additional things we're excited about.

I think that we have barely scraped the surface with respect to figuring out how to intelligently integrate advertising into video, into audio and into grocery. So, I think we're early days in that. I think that we also started externalizing some of our products like sponsored products to third-party websites. And you see that with what we've done with Pinterest, Hearst Newspapers and BuzzFeed, so I think there's -- again, we're still pretty early in that area, but it's growing well, and we're very focused on continuing to in a great customer experience. - CEO Andy Jassy