Instant gratification is becoming a staple of our way of life.

Amazon delivers digital products instantly and physical products to your door step in as little as 2 days or even 2 hours. The effort to reward ratio AMZN 0.00%↑ provides is unparalleled. While this theme of instant gratification may serve as an excellent trait to look for when picking winning stocks over the next decade, it is a powerful yet tiny tip of the iceberg when it comes to the kraken that is Amazon.

Amazon may very well become the everything store it initially set out to be and dominate commerce as a whole.

“We are genuinely customer-centric. We are genuinely long term oriented and we genuinely like to invent. Most companies are not those things. They are focused on the competitor, rather than the customer.

They want to work on things that will pay dividends in two or three years, and if they don’t work in two or three years they will move onto something else. And they prefer to be close-followers rather than inventors, because it’s safer.

So if you want to capture the truth about Amazon, that is why we are different. Very few companies have all of those three elements.” - Jeff Bezos, The Everything Store

We know from recent earnings reports that as Amazon increases delivery speeds, customers shop more often and spend more. More on that in my last article on Amazon below. Since I posted that article on November 2, 2023, Amazon stock is up 12%.

Amazon is perhaps the only company in history that can destroy competition without directly competing with them.

I’ve outlined why I believe Amazon will be a huge winner in the long term but there are many reasons why it’s showing promise in the short term as well. Input costs are declining. In the U.S. the average price of diesel fuel continues to drop, reaching $3.82 a gallon as of January 8. Add to the mix Amazon’s increasing use of robotics as well as electric vans, courtesy of RIVN 0.00%↑ and you have significant levers to pull to incrementally increase profits on the staggering amount of revenue Amazon rakes in.

I could go on about this, there are many additional reasons like the company’s shift to a regional distribution network that is more efficient and their fast growing, higher margin business segments like advertising, more on these in the article linked above and in the one below.

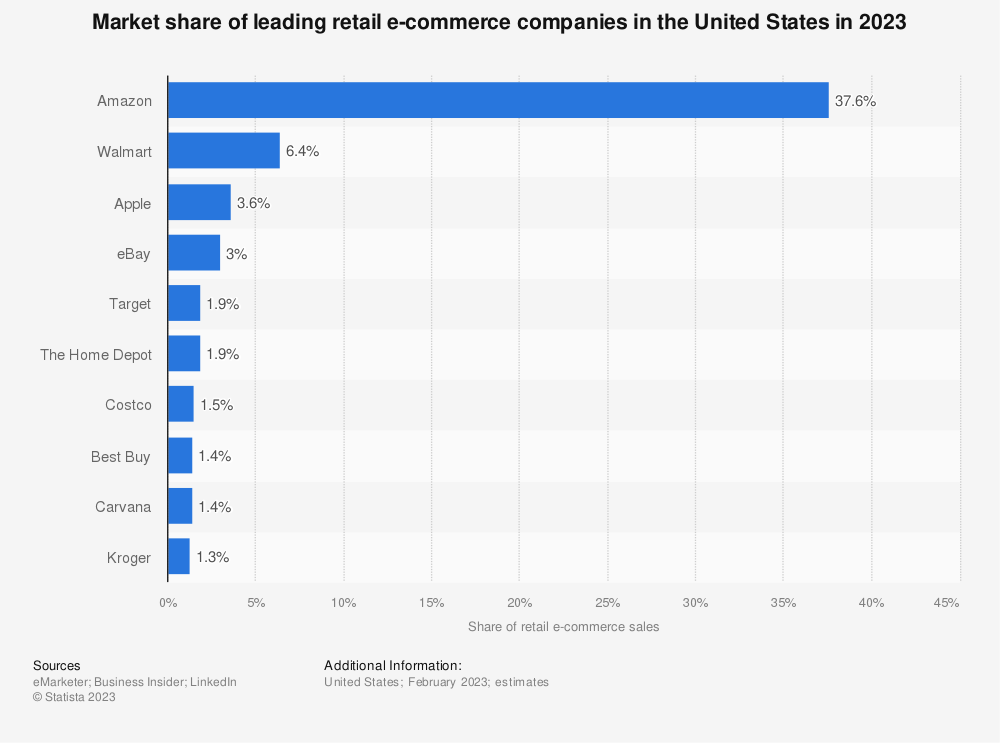

While the chart below shows you Amazon’s whopping lead in e-commerce sales, as of the 3rd quarter of 2023, e-commerce share of total U.S. retail sales was only 15.6%.

Internationally, global retail sales are over $30 trillion. In the last 12 months, Amazon did $554 billion in total revenue. That’s including all their business segments and is less than 2% of global retail sales. This is in line with statements by Amazon’s CEO Andy Jassy on how they’ve penetrated only a tiny amount of the global opportunity; There is massive runway for growth.

Amazon’s infrastructure and fulfillment network took over 2 decades and billions of dollars to build out, giving the company a huge MOAT.

This chart is from 2019, but you get the point. Amazon is at war with everyone, and far more often than not, they are winning. Missing from the chart and with a high chance for the upmost potential include the following segments of Amazon’s business: Whole Foods, healthcare, artificial intelligence, advertising and their intersection.

The company is building on its foray into healthcare with Amazon Pharmacy, Amazon Clinic and the acquisition of One Medical.

As I’ve discussed extensively in previous articles, the company has been growing at a fast rate in key high margin business segments over the past year (Ex: Advertising services grew 23% on average through the first 3 quarters of 2023) while most companies saw declining revenue, including AAPL 0.00%↑.

It seems the only risk to Amazon is becoming classified as a monopoly and the ensuing government intervention to break them up. They don’t yet have a monopoly in any one vertical, but they are hurtling toward a monopoly of the economy.

Yet at the same time, it has the potential to be a deflationary force that improves our lives. Transportation is one of the highest cost that gets passed down to the consumer when it comes to groceries and a significant cost for everything else you buy. Amazon continues to innovate and find ways to reduce these costs. Compare the following:

USPS, perhaps the shining example of everything wrong with the bureaucratic industrial complex. Their delivery trucks are an eye sore that look like they haven’t been updated since the 1970s. The only organization, who’s one job is to deliver packages, that seems consistent only in the fact that it’s a gamble whether your package will actually reach its destination. Compared with the futuristic electric Rivian vans that deliver packages to your doorstep in a matter of hours.

I think 2024 will be a big year for Amazon and regardless, it’s a stock I want to be in for the long term.

Amazon is an unstoppable force at this point that has arguably won capitalism.

Nice Article Vinny