Starbucks Stock CRASHING: Will it Recover or Get Worse? (SBUX Analysis)

It’s amazing that the news continues to tell you how great the economy is, yet if you dig just a little deeper, the best companies in the world continue to tell you it’s bad. Starbucks and other S&P 500 companies are quite literally the best and biggest companies which brings unique advantages, so when they tell you they’re struggling, that means it’s even worse for small businesses.

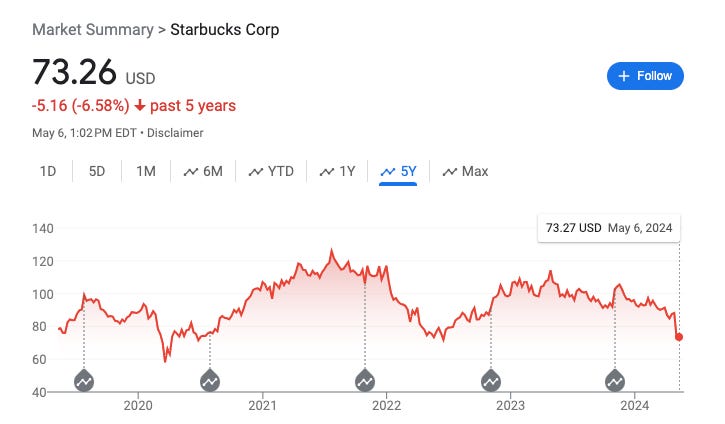

SBUX 0.00%↑ recent earnings call was terrible and the stock dropped 16% as a result. But, that’s what got me interested in giving the company another look and here’s what I found.

“We continue to feel the impact of a more cautious consumer, particularly with our more occasional customer, and a deteriorating economic outlook has weighed on customer traffic and impact felt broadly across the industry.” - Starbucks CEO Laxman Narasimhan

While Starbucks does sell highly discretionary overpriced coffee, you can extrapolate, if people are not buying $5 drinks, you can bet they are not buying the more expensive items in the discretionary category, so basically everything else.

63% of Starbucks’ beverage sales are cold, up 1% year over year for the 2nd quarter. This brings me to the main point I want to highlight. Starbucks actually seems like a somewhat seasonal or cyclical business, in which it does better in the warmer months. Because of this, the current quarter tends to be the weakest with business picking back up in the Spring, Summer and Fall. Therefore I think this is a great place to buy Starbucks as it is probably at or near the low.

As you can see below, Starbucks has reached this level every year for the past 4 years in May, the only time it went lower was during the pandemic. It then proceeded higher over the next few quarters. It makes sense that if 63% of their drink sales are cold, they will do better in the warmer months. Then the Fall benefits from a combination of warm weather and seasonal favorites like Pumpkin Spice Lattes and the disgusting Peppermint Mocha (Mint is only acceptable for teeth brushing, not eating, gross).

Big money agrees as someone sold 4,000 puts at a $70 strike, meaning they are willing to buy 400,000 shares of Starbucks for $28 million. I’d say this person is pretty confident this is the bottom and/or a great place to buy.

Thanks to the crash you also get a higher dividend yield now with Starbucks, 3.1% or $2.28 per share annually while you wait for the recovery. This means if you own 100 shares of Starbucks, you get paid $228 annually in dividends alone. The company is also increasing it’s dividend every year, they’ve grown it on average 10% annually for the past 5 years.

The one developing threat to Starbucks that I’m continuing to monitor is the rise of the energy drink space, mainly Celsius. I think these energy drinks are probably part of the reason you saw Starbucks sales decline and are worth keeping an eye on. Energy drinks are no longer reserved for vodka red bulls, people are drinking Celsius all the time now and perhaps in place of their Starbucks coffee. I continue to see people drinking them at the gym, it’s become a work favorite and some even like to drink CELH 0.00%↑ with their food as you see Jersey Mikes and Dunkin Donuts now carry Celsius.

It’s funny after I typed this I got to the part in the Starbucks report where they announced, big surprise, the launch of a low calorie energy drink!

“We're launching… a zero to low-calorie handcrafted energy beverage… And later this year, we will add up to five sugar-free customization options to our menu in response to both partner and customer requests. This will provide a lower-calorie option for approximately 80% of our beverages.” -CEO

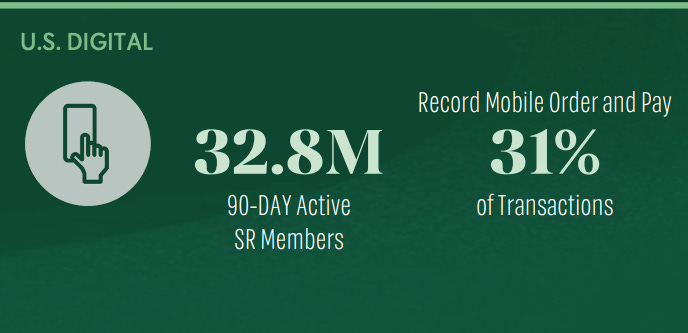

The company is also building more than 3,000 new stores globally this year. MOP (Mobile order and pay) set another record in the US this quarter and represented 31% of transactions and Starbucks rewards members now number nearly 33 million. This is a similar strength like I had highlighted with Chipotle’s mobile ordering trends in my article on CMG 0.00%↑:

Mobile ordering is here to stay and only growing, I think it is a huge strength for companies like Chipotle and Starbucks.

This seems like a really bad one off quarter. -1% revenue year over year is nothing all things considered, -11% China raises some concerns but I think this will all blow over and improve over the rest of the year as we move into the warmer months.

They did not issue great guidance but again I think this is historically the company’s weak quarter and perhaps this is a case of underpromising and overdelivering.

Thus, I started buying some Starbucks along with a few other companies which I announced in our Discord community today, sign up for the community tier to get access.

Later today we’ve got Symbotic reporting earnings, tomorrow both Rivian and Celsius. Subscribe so you don’t miss out!

Until next time!